Page 67 -

P. 67

Notes to the Consolidated Financial Statements

31st March 2016

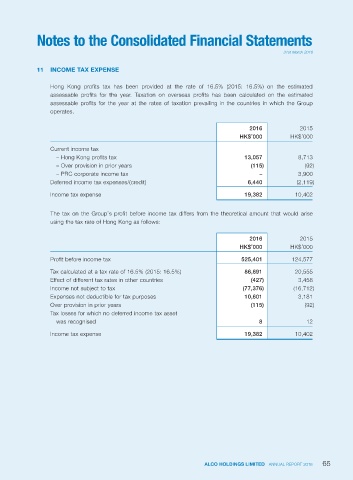

11 INCOME TAX EXPENSE

Hong Kong profits tax has been provided at the rate of 16.5% (2015: 16.5%) on the estimated

assessable profits for the year. Taxation on overseas profits has been calculated on the estimated

assessable profits for the year at the rates of taxation prevailing in the countries in which the Group

operates.

2016 2015

HK$’000 HK$’000

Current income tax

– Hong Kong profits tax 13,057 8,713

– Over provision in prior years (115) (92)

– PRC corporate income tax – 3,900

Deferred income tax expenses/(credit) 6,440 (2,119)

Income tax expense 19,382 10,402

The tax on the Group’s profit before income tax differs from the theoretical amount that would arise

using the tax rate of Hong Kong as follows:

2016 2015

HK$’000 HK$’000

Profit before income tax 525,401 124,577

Tax calculated at a tax rate of 16.5% (2015: 16.5%) 86,691 20,555

Effect of different tax rates in other countries (427) 3,458

Income not subject to tax (77,376) (16,712)

Expenses not deductible for tax purposes 10,601 3,181

Over provision in prior years (115) (92)

Tax losses for which no deferred income tax asset

was recognised 8 12

Income tax expense 19,382 10,402

ALCO HOLDINGS LIMITED ANNUAL REPORT 2016 65