Page 10 -

P. 10

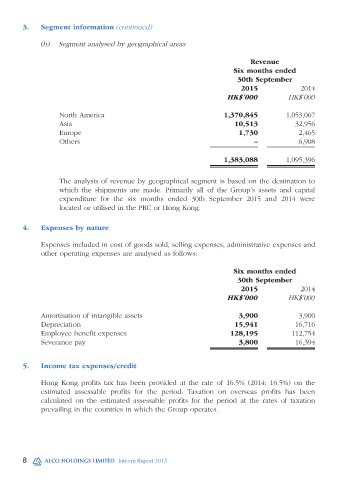

3. Segment information (continued)

(b) Segment analysed by geographical areas

Revenue

Six months ended

30th September

2015 2014

HK$’000 HK$’000

North America 1,370,845 1,053,067

Asia 10,513 32,956

Europe 1,730 2,465

Others – 6,908

1,383,088 1,095,396

The analysis of revenue by geographical segment is based on the destination to

which the shipments are made. Primarily all of the Group’s assets and capital

expenditure for the six months ended 30th September 2015 and 2014 were

located or utilised in the PRC or Hong Kong.

4. Expenses by nature

Expenses included in cost of goods sold, selling expenses, administrative expenses and

other operating expenses are analysed as follows:

Six months ended

30th September

2015 2014

HK$’000 HK$’000

Amortisation of intangible assets 3,900 3,900

Depreciation 15,941 16,716

Employee benefit expenses 128,195 112,754

Severance pay 3,800 16,394

5. Income tax expenses/credit

Hong Kong profits tax has been provided at the rate of 16.5% (2014: 16.5%) on the

estimated assessable profits for the period. Taxation on overseas profits has been

calculated on the estimated assessable profits for the period at the rates of taxation

prevailing in the countries in which the Group operates.

8 ALCO HOLDINGS LIMITED Interim Report 2015